Is real estate a good investment? Well, it certainly can be. If you’re wondering how to determine if your investment is a good one, then look no further. We’re here to help by providing you with the resources you need to determine if your investment makes sense for you financially.

Do You Have a Good Investment?

One primary concern that every investor often has (and one that they should have) is whether or not a particular property is a good investment. It’s not as simple as saying, “The house costs X dollars, and I think I can get Y dollars in rent from it each month,” and assuming that that is the only calculation you’ll need to make. You have to probe a bit further to see if this particular property is better than that.

Determine Your Gross Effective Income

To evaluate a property – especially when compared to other properties – you must first determine your gross effective income. This figure is calculated by finding your scheduled rents – how much you’ll make each month (extrapolate it for 12 months) – minus market vacancy and resident turnover costs. In other words, determine how often residents come and go and figure out how much it will cost you, on average, to get the property ready for the next resident.

Calculate Fixed and Variable Expenses

Once you have determined your gross effective income, you have to calculate your fixed and variable expenses.

Fixed Expenses

Property tax bills, hazard insurance policy premiums, and utilities all factor into fixed expenses. Professional property management is also a fixed expense.

Variable Expenses

Variable expenses include replacing significant systems within the home. You can estimate if you’ll have to cover these costs by determining how old each system is or how long it’s been since a system (such as HVAC, the roof, etc.) has been replaced or modified.

Find Out Your Net Operating Income

Take all of these numbers and subtract them from your gross effective income to get your net operating income.

Don’t Forget About Your Mortgage

Subtract your mortgage payments from that number to get what’s leftover. If it’s a negative number, this property may be a bad investment.

Find Out if the Property Meets Your Investment Criteria

Performing due diligence on a property is extremely important to determine if it is a good investment. If you have questions, you can always reach out to a local property management company for help with evaluating properties and your market.

Follow the 1% Rule

One quick way to determine if a property is worth investing in is by trying an initial analysis known as the 1% rule. Here’s how to calculate:

- Find the upfront cost of purchasing your property (including upgrade expenses or initial repairs)

- Multiply this figure by 0.01 to find 1%

Once you find this figure, figure out if you can charge that amount for rent. Be sure to look at rents in the area to see if it makes sense. If it doesn’t line up, you might want to steer clear of this property.

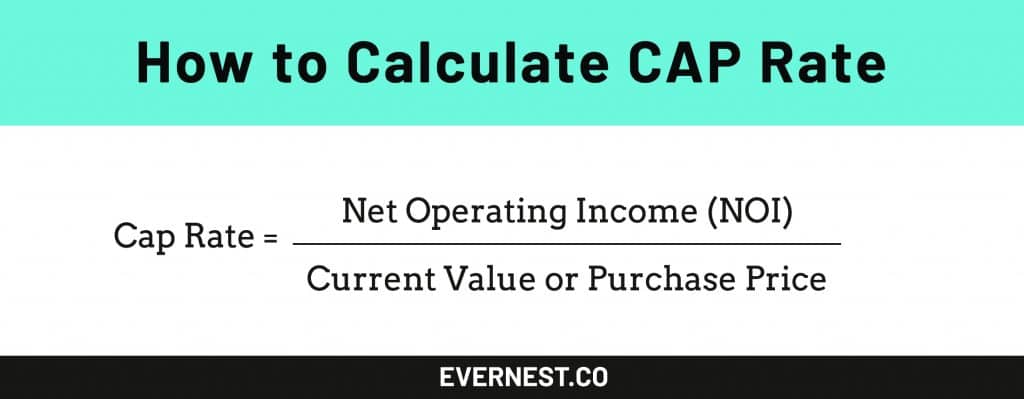

Check the Cap Rate

Another formula to look at is the cap rate, which is the return you should be generating if paying for the property in cash. Here’s how to figure out the cap rate:

- Find your gross income

- Subtract your monthly operating expenses from your gross income

- Divide this figure by the cost of your property

Take, for example, a property that will cost you $150,000. Depending on your market research, you determine that you could rent it for $1,100 monthly. If your monthly expenses come out to around $400, that means you are left with $700 net operating income monthly or $8,400 annually. Take that annual figure and divide it by $150,000 to get 0.056 or 5.6%.Depending on what your cap rate turns out to be, you can decide if it meets your investment criteria. For example, a cap rate of 5.6% may get excellent if you can find quality residents in an area forecasting economic growth. That same cap rate might not be good enough, though, if your property is older and in a less-than-desirable location.

Check the Neighborhood

Speaking of neighborhoods, you must spend the time checking out the surrounding area to the property in question. Here are a few questions you should always be able to answer before investing in a property:

- What is the neighborhood like?

- What is the condition of comparable homes on the street?

- Are there any nearby amenities?

- What are surrounding communities like?

Conducting research on the surrounding area will give you a good glimpse into what type of potential value the property may have. Safe, friendly, and clean neighborhoods are always of high importance to renters.

Check for Zoning Issues

Another popular check for real estate investors is to look into zoning issues and liens. Properties will be an automatic no for most investors with any type of characteristics or complications in line with zoning issues and liens.On smaller, non-institutional grade properties, these might be characteristics to look for, though. Depending on your investment style, these properties tend to be too small of projects for institutions yet too expensive for DIYs.

Is My Property A Good Investment?

So, hopefully, you no longer have to ask - is real estate a good investment? The real question is, is my property a good real estate investment? And, now you know how to answer that on your own.