What a property manager does is more than most expect. And yes, it’s more than only fixing leaky pipes and chasing down monthly rent payments. From being your local, boots-on-the-ground expert, knowing all local, state, and national laws, and reducing the cost of maintaining your property—hiring a property manager is one of the best investments you can make as an owner.In this article, you’ll learn what a property manager does day-to-day when it comes to the management of your property, and why you should consider hiring one.

What does a property manager do?

Here are 10 things a property manager does for owners like you:

1. Simplifies investing out-of-state

Real estate is a localized game. Due to the attention needed for day-to-day operations on a property, local knowledge of laws and regulations, and everything in between—investors buying from another location are better served when they hire a property manager. A property manager will be your eyes and ears on the ground. Their job is to perform tasks like:

- Interact with your residents

- Regularly inspect your property

- Provide local market knowledge

- Recommend neighborhoods to invest

- Keep an eye on your property during a vacancy

- Identify areas that need Section 8 or subsidy funding

- And more

The tasks and expertise listed above are difficult information to come across when you aren’t local to a market. Keep in mind that some owners are buying to revitalize, some may want a hands-off approach and an easier asset to manage—hiring a property manager enables investors and owners to do so in markets they lack experience. One thing you should spend more time considering regarding your property: how are you going to handle vacancies?Following a vacancy, there’s a length of time in which you must remit the security deposit. If you don’t pay up within that period, as the landlord/owner, you are liable to refund more than the security deposit. Working with a professional property manager (like Evernest), we follow a strict process to ensure this transition is done smoothly and efficiently:

- We establish utilities and inspect the home

- The move-out inspection is sent to the owner

- We create both a rehab estimate, as well as suggested resident charges.

- Tenant charges are sent to the owner in order for them to review and approve.

- And as long as they approve them, we then handle all of the accounting sides of applying the security deposit to the charges.

Reconcile the deposit? Move out? We are boots on the ground and can handle it all. As an out-of-state investor, you need local people you can trust your asset with. A residential property manager, who knows your investing goals, is there to free you up from needing to be local.

2. Know landlord-tenant laws and regulations

When it comes to knowing landlord-tenant laws and regulations in any market, property management expert, Leslie Wilson, CAM®, a seasoned property manager with 17 years of experience managing student housing, and multi-family and single-family residential properties says, “in my opinion, this is one of the most critical aspects of owners choosing a property management company”. Leslie says, “This is because each state has its own statewide landlord-tenant laws and subsidy departments. For example, in Birmingham alone, we have four different municipalities that handle Section 8, and each one of them has different requirements, different processes, different timelines, etc.”What does this mean? If, as an owner, you don't have someone who knows the local system, how to handle the paperwork, and the timelines, you're going to be at a loss. This is where having a property manager is a huge benefit. These laws and regulations vary from state to state, county to county, and city to city. A residential property manager will know everything from local laws and regulations to the percentage of homes in the area needing subsidies, restrictions, collections, etc. “There's a lot of liability taken off of the owner by employing us as the property manager, simply because we have essential knowledge and understand the processes from A to Z.” Suggested Reading: The Uniform Residential Landlord-Tenant Law

3. Respond to maintenance requests

One common responsibility of a property manager is to handle all incoming maintenance requests from residents. Do you know the biggest cause of resident turnover? Slow responses to maintenance requests. Responding in a timely manner to these kinds of requests keeps the resident (as well as the owner) happy and satisfied with their living situation. This is the job of a property manager. Ideally, a property manager will review incoming orders day-to-day, giving the owner additional eyes on the work being done to their property. From a monetary standpoint, this allows property managers to look out for the well-being of the owner. “It goes without saying, you're going to have residents that are going to input work orders that are not needed. They're more of a want than a need. And so having someone to look at those and say, "Okay, this is an aesthetic issue that needs to be pushed back on the resident as a resident responsibility rather than being input as a maintenance request." Again, it's going to save the owner and help educate the resident as well as reinforce the lease that they've signed.”

4. Customized Reporting for the Owner

As an owner, having an in-depth analysis of your property is difficult to make time for—unless you have a professional property manager. As an example, owners who work with Evernest can elect into what we call the Annual Property Condition Report. For $149 per year, owners will receive a comprehensive report that's sent directly to them on their property. It includes anywhere from 60 to 90 photos of both the interior and exterior of the property. It covers critical features like:

- Roof condition

- Overall landscaping

- Trees that need to be trimmed

- Downspouts that are coming off

- Overall cleanliness and state of the property

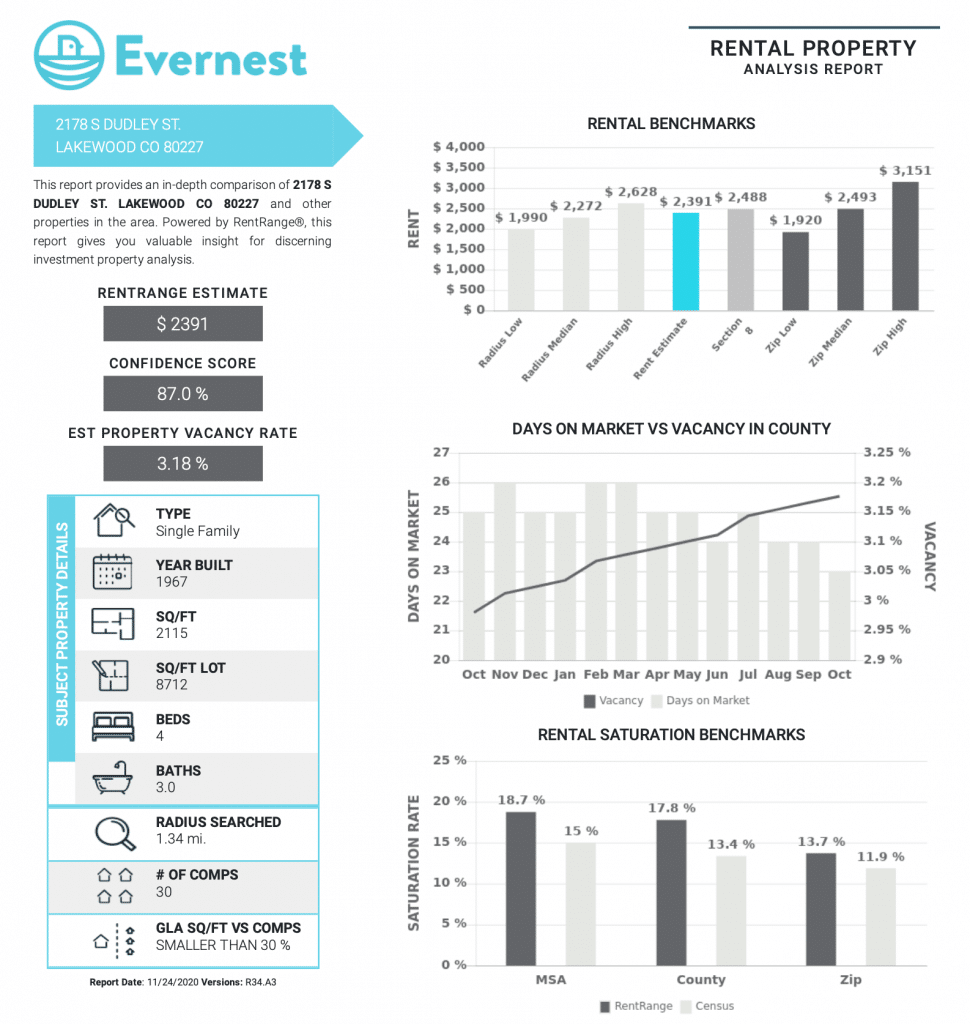

“As property managers, we can review those reports once they're completed and make recommendations to the owner. Things like, "Hey, we notice your resident has not input this leaking roof in the kitchen as a work order, but there's a pretty significant stain on the ceiling. Would you like for us to proceed?” Because of this, we tend to catch a lot of items that are maybe not reported by the resident, which is just overall better care of the home.”This kind of reporting will be missed by most investors or owners opting to self-manage. Speaking of reports…Want a FREE rental report for your property? Get yours here.Here’s a snapshot of the custom report you can grab:

5. Control maintenance costs

Remaining diligent and staying consistent when it comes to maintenance requests on your property will keep costs down and prevent more major issues in the future. Your property manager will conduct routine inspections to:

- Make any necessary repairs

- Guarantee the residents are complying with the lease.

Being a larger residential property management company, our team at Evenest has an in-house maintenance team. This allows us to get the best prices and discounts from vendors, which easily turn into extra savings for our owners.This also means you have one less person (ie. a trustworthy repair person) to add to your team. In this case, your property manager would already have relationships with approved and insured vendors. This kind of value shouldn’t be overlooked. “If you have an experienced property manager that's done it for a while and has a relationship with local vendors, they have a lot more knowledge as to what's fair and reasonable pricing for certain large ticket repairs. So if I was, for example, passed a bid to replace the three-ton HVAC system for $12,000, I'm going to immediately send it back and say that's too much, and request a better bid.”“Whereas if you have (an investor) from out of state that doesn't know what material costs are or what the local rate for labor is, you could be overcharged. So you've got that added layer of benefit in having someone looking at those estimates, and making sure that we're treating the property as our own and that we're looking at each expense and the best benefit of the owner.”In the case that something happens at your property, you can anticipate receiving:

- Pictures of the damage

- An itemized estimate of the repair costs

- An itemized statement after the repairs are made

6. Market your property and fill vacancies

Eventually, residents move out. If your resident moves out and you plan on renting again, there are a few things that need to happen and fast. After all, the longer your house sits empty, the longer you aren’t making money.As property managers, we call this “the turn.” This is the time to get the property ready for another resident to move in. There are some critical steps to completing a turn – from move-out to move-in – that you'll need to tackle (unless you have a property manager). You can expect your property manager to:

- Try to extend the current resident

- Make any necessary repairs to the property

- Market the home after the resident gives notice

- Raise rent rates (if necessary) to be competitive in your market

Working with a property manager during this phase can save you a ton of headache, time, and money. With larger, more established residential property management companies, you’ll likely have access to an in-house leasing team, as we have here at Evernest. “Our leasing team does a phenomenal job. They are fielding all of the calls and emails daily, and keep a good pulse on what residents are looking for, and what zip codes have more price-conscious residents. In those situations, we're able to make recommendations to owners to place a high-quality resident, faster.”Other benefits to having a property manager at this phase of your property:Custom Comp Reports: “We are able to produce comp reports and send our owners a very detailed report showing how their home compares to others, and what the recommended rent amount is for the listing rate. Also, this report includes competitors within a several-mile radius that are truly comparable. It will include details like rent estimates, confidence scores, property vacancy rates, rental benchmarks, and more. ” Potential Rental Rate Increase Post Rehab: “If you work with a property manager like Evernest and we are awarded the rehab, we're able to increase/adjust listing rate suggestions to help accommodate for the capital that's being put into the home during that process.” Local Market Insights “There are also insights property managers can provide you with like certain areas of town you would do better to lease a home in if you allowed pets, or if a part of town does better with Section 8 housing. Your property manager will also know the local job force. We know more about how many people are coming to the area. This is helpful when it comes to listing rates and anticipating how long the home may sit vacant.”Your property manager can give that necessary context and insights into a local area that can really make a difference.

7. Screen residents and collect security deposits

Having a very strict underwriting process greatly lowers your chances of losing money. A professional, residential property manager underwriting process will include:

- Background checks

- Credit checks

- Proof of employment

- Rental history/contacting former landlords

- Criminal and terrorist lists checks

- As well as evaluating necessary pet information

The most important thing your property manager will do during this phase will be to make sure everything is done in compliance with fair housing and anti-discrimination laws.When an applicant is recommended for approval—and you as the owner have been consulted on the approval as desired—the property manager will collect the security deposit and hold it in escrow so that, in accordance with the rules, those funds are never co-mingled.Here are some things included in our underwriting process at Evernest:“First, we do not outsource our underwriting to someone that wouldn't have the same interest level for the owners at heart, the way we do. So we, for example, are very strict with rental verifications. We want to make sure that there are no evictions or rental balances on the credit report, period. That's something that without having the screening technology that we have, an owner wouldn't be privy to.” “We will charge either a single or double deposit based on an applicant's credit results, which gives an added layer of protection to the owner. This is because if you've got a resident with a lower credit rating, being able to go in upfront and take a two-time monthly deposit is just helping the owner in the long run on potential rental balances, during move-in, move-out, and/or charges for damages or cleaning.”

8. Reduce the cost of management

A question we often get asked is, “Would I actually save that much money if I used a property manager?” One thing we encourage investors and owners to consider isn’t the monetary factor (at first), but rather your time. Do you have the time to manage your property yourself? Owning rental property is a full-time, hands-on job—one that requires a lot of attention and near-constant availability.To get an idea of how much self-managing your property will cost you, think in terms of opportunity cost. Use this formula:Your Hourly Wage X Hours Per Month Spent Managing Your Rental = Money Lost Per Month (ie opportunity cost)NOTE: The formula above isn’t bulletproof, nor does it take into account all factors. The topic of opportunity cost goes beyond only hourly wage and hours spent managing your rental. It will include different factors such as any possible losses and opportunities to focus on higher-return activities.Another way to think of it is if you enjoy the “art of the deal”. Wouldn’t you rather be in the market purchasing more properties, than self-managing and not finding more deals?If you purchased one more house per year with your freed-up time, then you would be financially way ahead of if you were still self-managing. Particularly, over the course of 3-5 years.And as discussed above, a property manager can and will save you money by:

- Negotiating better bids on rehab estimates

- Handling vacancies more effectively and efficiently

- Removing the liability of doing things incorrectly with Section 8 or evictions.

9. Collect rent and handle delinquencies

One of the biggest reasons you rented your house out in the first place was to collect rent (ie monthly income). This is especially important if you started out with the plan to use that money to pay the mortgage on your own home. Tenants get behind on rent or flat out don’t pay due to things like:

- Loss of job

- Family emergency

- Poor cash management

…and 427 other reasons we’ve heard in our 15+ years of managing properties. This is where your property manager comes into play. As Leslie Wilson sees it, “this is the biggest responsibility of a property manager—to send out owner statements and provide a snapshot of delinquent accounts.”Your property manager is there to:

- Collect rent and make sure monthly payments clear

- Take care of all resident communication

- Communicate lease expectations

- Some property management companies (like us!) can even help you receive payment faster by allowing residents to pay online and then transferring the funds electronically to your account.

- Set up payment plans with residents when necessary

- Handle collections and evictions in the case those arise

This is one of the MAJOR benefits of having a diligent property manager.

10. In-house Brokerage

Let’s say you’re an investor who…

- Wants to grow your portfolio

- Has had a lot of issues with a house

- Has had a resident that's not paying

- Or simply doesn’t want to deal with rentals anymore

Wouldn’t it be simpler if your property manager was also a broker? You’re in luck. When you work with a residential property management company like Evernest, you also have quick access to our in-house Brokerage!“Whether investors want to add to their portfolio, bring on new assets, downsize or completely eliminate their portfolio, we have the ability to help you do that. These are the same people that already have a direct history of all the work orders and all the capital that's been put into improvements on the property. It simply makes things a lot more seamless for the owners to work with our Brokerage.”

Where do you go from here?

As a rental property owner, choosing to utilize the services of a management company is a big decision. Now that you know what they do, you should take time to understand property management fees.It’s good to be aware that there are additional fees property management companies may charge you. Common fees include:

- Contract Setup Fee

- Procurement or Leasing Fee

- Overseeing Vacant Property Fee

- Maintenance Fee

- Late Payment Fee

- Eviction Fee

You can read more below. Suggested Reading: What Are Average Property Management Fees?_________________________________

Contributor: Leslie Wilson

Leslie Wilson, CAM® is a seasoned property manager with 17 years of experience within the property management industry, and currently works as the Institutional Property Manager at Evernest. She has experience managing student housing and multi-family and recently transitioned into the single-family rental market. She currently serves owners as their liaison between multiple departments and manages their accounts both personally and professionally.