Not all real estate investments are created equal.

As an investor, you’ll need to weigh countless factors including school systems, the age of the property, the state of the neighborhood, your personal degree of risk tolerance, and more. The neighborhood classification system can help you make the right investment decisions every time.

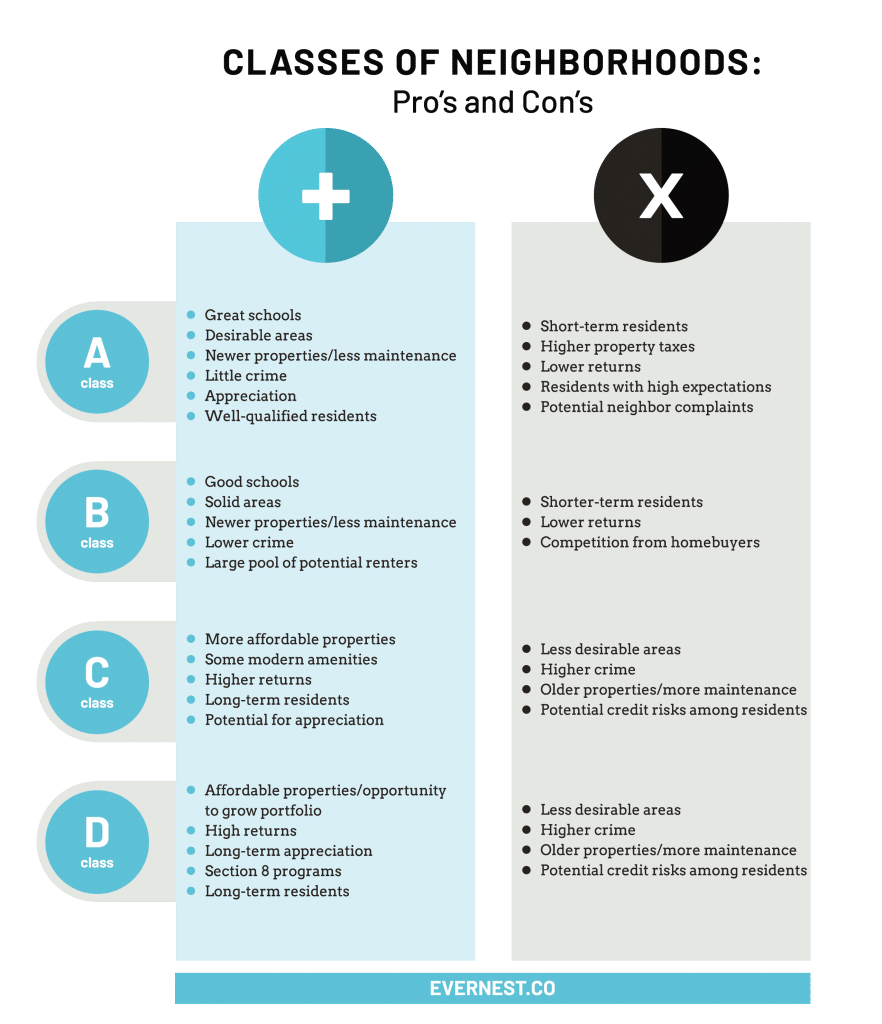

A, B, C, and D Class Neighborhoods

When first starting out in real estate investing, the concept of neighborhood and property class is your North Star.

Think of these like a letter grade awarded to the different neighborhoods within your market. For example, the most affluent neighborhoods in a given market will be considered A-Class, while those that are older, lower-income, or higher-crime may be considered B, C, or D Class.

It’s important to note, though, that class will look very different in each market. For example, A-Class neighborhoods in Birmingham might be considered B Class in Denver or Boulder. What’s more, investors and real estate professionals in the same market might disagree on a neighborhood’s classification. What’s considered a C+ to one investor maybe a B to another. Not to mention, class is never set in stone. Neighborhoods are constantly growing, changing, and evolving, so a C Class neighborhood today could be considered B Class down the line.

It’s also important to note that there is no value judgment associated with a neighborhood’s classification. There are pros and cons to investing in each type of neighborhood, and the right choice for you will depend entirely on your unique goals and motivations.

Why is Property Class Important?

It’s important that you understand the general indicators of a neighborhood’s class so you can make these determinations for yourself and choose a neighborhood and property that best fits your goals as an investor. Think of this classification system as a jumping-off point, or a means to narrow down your options and better understand your investment.

Property class plays a big role in determining your buy box, or the parameters you consider ideal for purchasing an investment property. Factors like,

- your ideal resident,

- risk tolerance,

- and goals

—will all meet in a property’s class. A thorough understanding of the identity of each neighborhood and whether or not it aligns with your goals will help you make the right investment decisions.

Understanding and developing a buy box around neighborhood classifications is also a good way to immediately disqualify certain properties. For example, if you hear about a great C Class property but know that your buy box consists of only B Class properties, you have a quick and efficient way to pass.

Suggested Listening: Setting Your Investment Goals

Pros and Cons of Each Property Class

Each neighborhood classification is unique, and properties will come with their own benefits and drawbacks:

A and B class properties tend to be lower-risk.

These neighborhoods often have strong school systems, fantastic appreciation, and a pool of well-qualified residents ready to move in. They also tend to be primarily white-collar, although some B Class neighborhoods may be geographically closer to blue-collar areas. Homes are typically newer, and residents are more likely to take good care of the property.

While they are low-risk, these neighborhoods also tend to be lower-reward. You’re unlikely to have a long-term resident, as this demographic may eventually relocate to a trendier neighborhood, purchase a home, or otherwise leave before someone in a D-class neighborhood might. You’ll also typically pay higher property taxes, which eat into your income, and residents may have higher expectations, submit more work orders, and request more maintenance and repairs. The neighbors in these areas may also be less enthusiastic about renters.

The benefits of C and D class properties are essentially the inverse.

These neighborhoods may be higher-risk, but they’re also higher-reward. Properties are more affordable, cash flow is higher, and tenants are more likely to stay long-term. Your dollar also will go further here, so there’s ample opportunity to purchase multiple properties, grow your portfolio, and mitigate some of that risk quickly and efficiently.

As far as cons go, C and D Class neighborhoods tend to have higher crime rates, older homes requiring more maintenance, and residents with potential credit risks. In these properties, finding an ideal resident, who will pay rent on time and effectively maintain the property, is critical.

Which Property Class is the Best Investment?

So, with pros and cons for each class of neighborhood, where do real estate investors tend to gravitate?

Most real estate investors find a sweet spot in the C+ to B- category. This point tends to balance risk and reward but, with so many interested investors, competition is increased.

Just because it tends to be the most popular property class among investors, though, doesn’t necessarily mean that it’s the right one for you. Getting to know the neighborhoods within your market, ideally in person, and practicing classifying can help clarify where you should invest.

How to Determine a Neighborhood’s Class: 6 Factors to Consider

When determining where you’d like to purchase a property, you’ll want to build a profile for your ideal resident. Ask yourself questions like:

- Where do they work?

- Where do they live?

- Where do they like to shop?

- How much do they make per year?

- What do they do with their free time?

To craft this image and eventually choose a neighborhood, begin by analyzing the local school district, age of the home, nearby commercial property, local employers and employment data, crime and other public statistics, and the potential of the neighborhood or property.

Here’s a closer look at each of the factors your need to consider:

School Systems

Naturally, more desirable neighborhoods will fall into more desirable school districts. This means that a school system’s rating is one quick and easy way to begin determining an area’s class. Having a highly-ranked school nearby is one good indicator of A-Class real estate, while those that are more middle-of-the-road may fall into the C or D category.

Pro tip: If you are purchasing a property largely based on school systems, ensure that you have accurate information. In some areas, homes on the right side of any one street may fall into a different district than those on the left, and any misinformation will almost certainly upset residents when they go to register their children.

Age of the Homes

In the same vein, newer, nicer homes are often found in A or B Class neighborhoods as opposed to their C and D Class counterparts, but there can certainly be some crossover.

In general, a home’s age can provide indicators of the property’s quality of major systems, degree of maintenance, and, as floorplans have evolved, even functionality. Newer homes also tend to be more attractive to renters.

While any significant issues related to the age of the home will likely come out during due diligence, considering this factor before making an offer can help ensure the property fits your buy box and aligns with your goals right off the bat.

Nearby Commercial Property

Another key indicator is local commercial real estate. In other words, the nearby stores, businesses, and retailers can provide insight into a neighborhood’s class.

A-Class neighborhoods will have higher-end stores, such as Whole Foods or Natural Grocers, luxury car dealerships, and designer storefronts. As you move into C and D Class neighborhoods, you might begin to see car part stores, pawnshops, or payday loan suppliers. To get insight on nearby commercial property it’s best to drive or walk the area, but exploring via Google Maps works well, too.

Remember not to make any value judgments while determining neighborhood class. Simply assign the corresponding letter grade to the elements you’re observing.

Local Employers and Job Rates

Next, dig into what residents in this neighborhood might do for a living. Research any large, incoming employers, local employment rates, and average salaries.

These statistics can help determine class, as white-collar workers typically live in nearby A or B Class neighborhoods, while those in C or D Class neighborhoods are more likely to work blue-collar jobs. Large, reliable employers and consistent average salaries can also be key indicators of resident longevity.

Crime and Other Public Statistics

You’ll also want to investigate public statistics related to the neighborhood. Crime rates, walkability, and even neighborhood ratings are all good places to start. As a reminder, A and B Class neighborhoods often have lower crime rates and higher walkability, while C and D Class neighborhoods are typically the inverse.

Pro Tip: If you can’t find much, consider simply checking Google News alerts related to the neighborhood. The most recent headlines can provide valuable insight into what’s happening in this neighborhood on a day-to-day basis.

Property or Neighborhood Potential

Finally, you may want to consider the potential of a property or neighborhood when determining class.

For example, recent real estate initiatives have converted C and D Class neighborhoods across the nation into A and B Class areas. Take Brooklyn, New York, and Oakland, California, for example. It’s important to consider the fact that a neighborhood’s class isn’t fixed.

In the same vein, offering, for example, a B Class property in a C Class area could decrease vacancy, yield higher returns, and improve client satisfaction. Even relatively small upgrades, like quartz countertops or stainless steel appliances, might entice residents in a C or D Class neighborhood and encourage a longer-term stay. Essentially, the potential of a property or neighborhood should also be weighed heavily when considering class and determining where to buy.

Get Started Buying Homes With Evernest

Like much of the real estate investing process, choosing a neighborhood is not a one-size-fits-all process. The right area will depend on your resources, goals, and preferences, and there are pros and cons to each and every one. Luckily, you don’t have to go it alone.

If you’re ready to buy your first (or next) investment property, here are 3 steps to get started today:

- Subscribe to our podcast: The Evernest Real Estate Investor Podcast—for all things real estate investing, being a landlord, growing your portfolio, and more.

- Find a property: Make sure you sign up for our Pocket Listings to get notified of all the deals that come across our desk daily.

- Get an investor-friendly agent: We can help with that—we would love to help you buy your next rental property investment.